45+ why did my monthly mortgage payment increase

If your mortgage is escrowed the monthly payment may change to reflect increases or decreases in taxes andor insurance. Web The reason why I say most cases is that not every borrower chooses to include escrows into their mortgage payment.

How The Interest Rate Increase Affects Your Mortgage Repayments

An increase in homeowners insurance premium.

. Other events might increase your payments as well. Ad Understanding Reverse Mortgage And Its Calculation. You Eliminated Your Private Mortgage Insurance If you put down less than 20 of your homes purchase price at the closing table youre required to pay private mortgage insurance.

Your servicer miscalculated fees. Or your insurance bill may increase if you remodel. Web The increase could come from a number of factors and there may be something you can do about it besides paying more each month.

Web Changes in your property taxes or homeowners insurance are two of the most common reasons for a mortgage payment increase. Dont panic take time to assess the situation and speak with your insurance agent. An increase in property taxes in your area.

An increase in your escrow payments could be due to tax and insurance rate fluctuations. Web Mortgage payments can fluctuate because of changes in the economy like interest rates rising but can also change for other reasons such as if your property tax or homeowners insurance. Sometimes escrow accounts are required by mortgage investors.

Web Mortgage payments can fluctuate because of changes in the economy like interest rates rising but can also change for other reasons such as if your property tax. The interest rate charged may increase or decrease at a specific time and periodically as agreed upon at the inception of your loan. Web Its after escrow analysis that you might see your fixed-rate mortgage payment go up.

Web As you can see there are several reasons your mortgage payment can increase from increased insurance costs and taxes to mistakes and adjustable rates. VA Loan Expertise and Personal Service. Web When your property taxes or homeowners insurance increaseor decrease for that matteryour monthly mortgage payment will also be affected.

Compare More Than Just Rates. Web The benefit of an ARM loan is that the initial interest rate is typically lower than that of a fixed rate loan. You could pay a discount point to reduce the interest.

You can get multiple quotes for. For example the value of your home may increase pushing up your property tax bill. Many lenders incorporate the following elements into the bill for.

Msn back to msn home money. Get Your Quote Today. But youll want to keep in mind that your monthly mortgage payment could fluctuate according to the terms of the note you sign.

Web Had we refinanced our mortgage to a new 30-year loan our monthly payment wouldve decreased by about 300 a month but wed have also spent around 142000 in interest over that 30-year repayment. As an example consider a homeowner Mark who lives in Austin Texas. APR helps you evaluate the true cost of a mortgage.

Web Mortgage Payments Increase When Taxes or Insurance Go Up If your mortgage has an impound account your total housing payment could go up An impound account results in homeowners insurance and property taxes being paid monthly If those costs rise from year to year your total payment due could also increase. Web There are a few reasons your monthly mortgage payment could go up. Web There may be circumstances where you find your mortgage payment has increased.

Looking For Reverse Mortgage Calculator. Your property taxes or homeowners insurance increased or you may have an ARM. Find A Lender That Offers Great Service.

Your property taxes increase or decrease. Contact a Loan Specialist. Getting Out of Escrow Your lender may not require you to handle taxes and insurance through escrow.

Web A mortgage calculator can help borrowers estimate their monthly mortgage payments based on the purchase price down payment interest rate and other monthly homeowner expenses. These funds are held in an escrow accoun t included with your mortgage payment. Web Common reasons your escrow payment might be going up include.

Any eligible borrower that chooses not to include escrows in a payment will never have to worry about a fixed-rate mortgage payment going up. Web Mortgage APR reflects the interest rate plus the fees charged by the lender. Property tax assessments are conducted periodically by your.

Web Since tax rates rise more often than fall its likely this part of the escrow account will increase each year and cause your monthly payments to increase. Any changes made to your monthly payment will be explained to you in the yearly escrow analysis which is provided by your mortgage servicer. The changes are common but the solutions are easy.

Web The 40 Rule and the 45 Rule in House Buying. Trusted VA Home Loan Lender of 300000 Military Homebuyers. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

Web Because your escrow amount is based on a forecast of the next 12 month of taxes and insurances if your insurance or property taxes increase your escrow requirement then your mortgage payment will also go up by default. Web Your escrow payments however will likely vary on a yearly basis.

Don T Let The Amex Platinum S Lifestyle Benefits Distract You

A Shift In Borrowing Patterns Interest Co Nz

Here S Why Your Monthly Mortgage Payment Increased Fox Business

With Stimmies Fading Consumers Dip Into Credit Cards For First Time Since 2019 But Only A Little Everyone S Relieved Wolf Street

Yshnnsefxfkyum

Redfin Sun Belt Buyers Need 40 More Income Than They Did A Year Ago To Afford A Home The Business Journals

Your Mortgage Wait Why Did My Payment Go Up

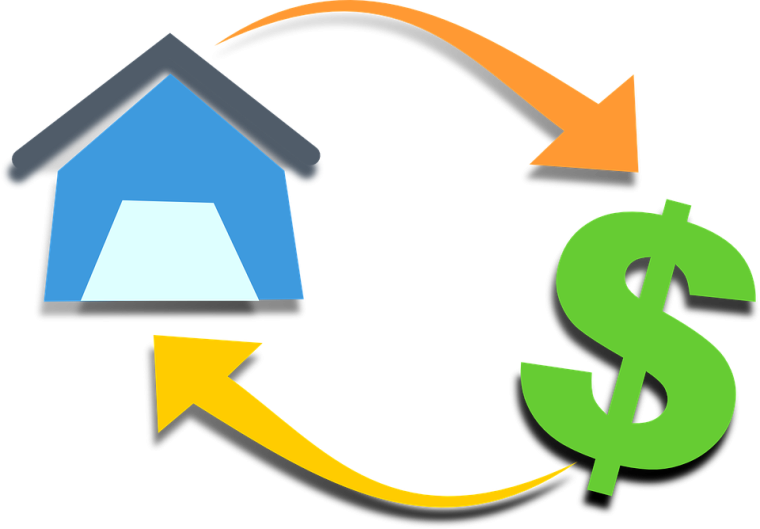

Retirement Survey Don T Leave It Too Late Fpi

Which Formula Dictates That You Pay More Interest At The Beginning Of The Loan Quora

Use These Charts To Quickly See How Much The Higher Mortgage Rates Will Cost You

How Much House Can I Afford Moneyunder30

The Washington Informer June 9 2022 By The Washington Informer Issuu

How Is Buy Now Pay Later Superior To Credit Cards Quora

Mortgage Software Prices Reviews Capterra Canada 2023

Can My Monthly Mortgage Payment Ever Change

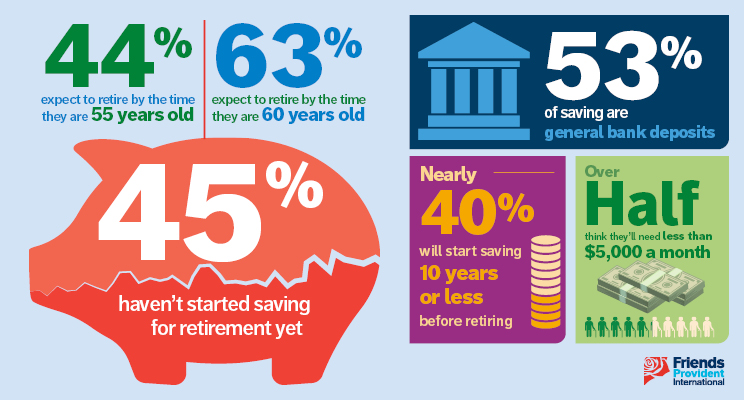

A Bridge To Lower Rates Ratespy Com

What To Do If You Can T Afford Closing Costs Freeandclear